If your business is already profitable and bringing in more than enough money to cover your start-up and recurring costs, then you're past breaking even. That depends on whether you have a business that still needs to reach that break-even point, or whether you already have a profitable business and just want to track income and expenses. Add in your Variable Costs to complete the calculation.ĭo I need a break even analysis template? Enter your price and monthly sales at the top of the grid, and then fill in your Fixed costs, including both one-time Startup Costs and Monthly Recurring Costs. Use this worksheet if you know your rate of sales and price per unit, and want to calculate how long it will take you to break even. Enter your number of available units for sale at the top of the sheet, and then fill in the rest with Fixed Costs and Variable Costs per unit, as above.

Use this worksheet if you have a fixed number of units to sell, and want to calculate what price they have to be in order for you to break even. Be sure to include your Tax Rate for an accurate calculation. Leave the Targeted Net Income at $0 to calculate the break-even point, or raise it to calculate how many units are needed to reach a certain profitability threshold. Enter your per-unit Selling Price at the top of the sheet, then fill in your Fixed Costs and Variable Costs per unit. Use this worksheet if you know your costs and price per unit, and want to calculate how many units you need to sell in order to break even.

#Break even graph free#

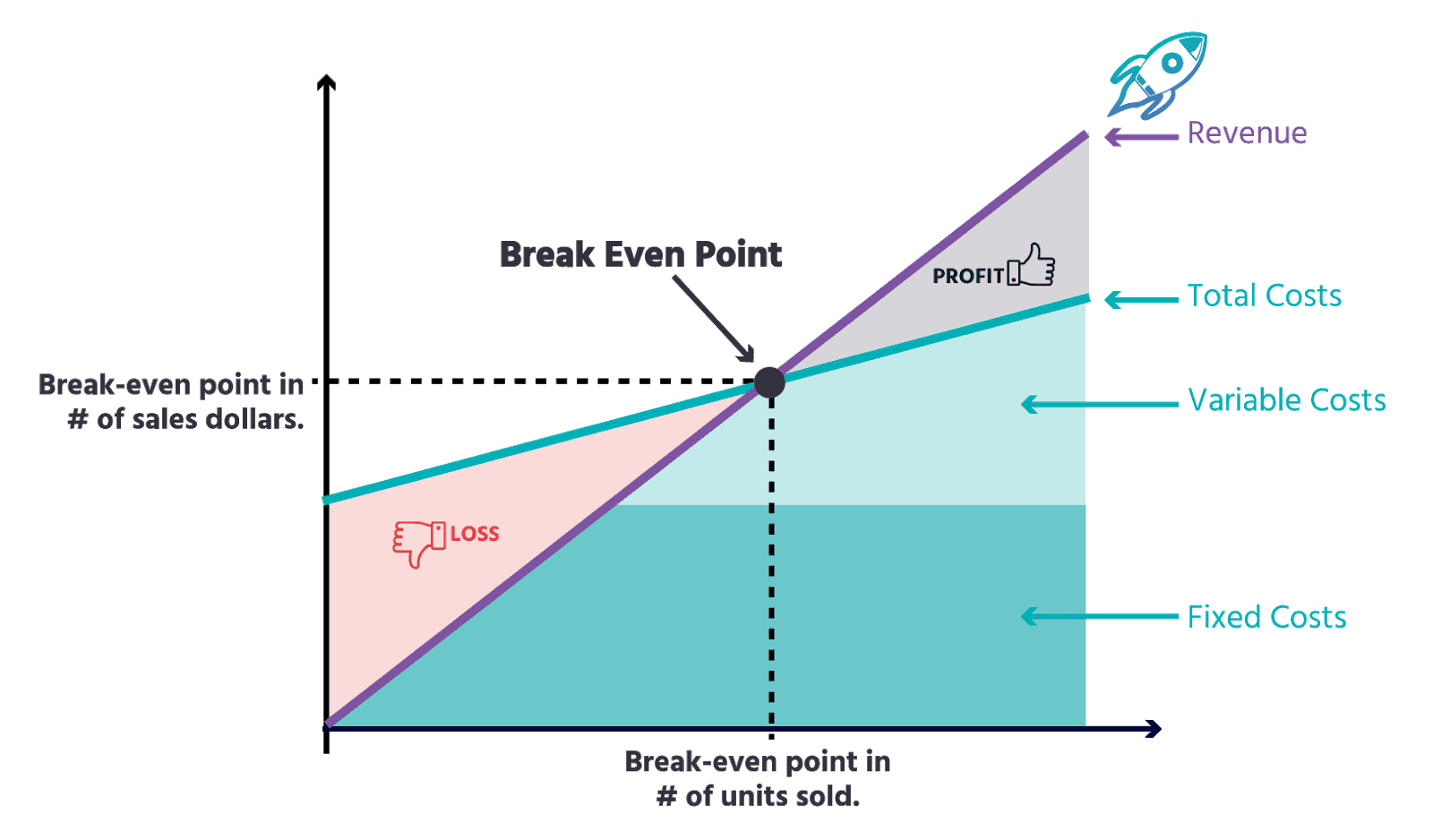

This free alternative to a break even analysis Excel template offers three different ways to calculate a break-even point for your business, depending on what you need to know. But every business needs to figure out when that break even point will arrive, and whether they can hold on that long - and that's what a break even analysis template is designed to calculate. Other businesses may be in it for the long haul, and happy to grow an audience while running at a loss for seven years as long as they can reach the break-even point in year eight. And "in time" varies for every business some businesses may only have a year to hit break-even before funding disappears. The important thing to figure out is whether your business will reach that important break-even point in time. Generally, the break-even point is the turning point for a business a business which can pass it and become profitable generally does well, while a business that never manages to reach it ends up failing and going out of business. when its costs and expenses will be completely covered by revenue. In short, a break even analysis is a financial method for evaluating at what point a business will break even - i.e. Your first question about a new business plan may be "Do I have to wear pants?" But your second question is probably, "When would this business become profitable, or at least stop costing money?" And it's the answer to that second question that a break even analysis template helps you to figure out.

0 kommentar(er)

0 kommentar(er)